The workwear industry in the UK is a significant contributor to the country’s economy, employing over 50,000 people and having an estimated £13 billion ($16.2 billion) global market share. It encompasses various sectors that cater to the

This article provides a comprehensive overview of the UK workwear industry, including market segments, market size and growth, market trends, market drivers, challenges, leading manufacturers and retailers, and future opportunities.

Overview of the UK Workwear Industry

- The global workwear industry has an estimated market share of £13 billion / $16.2 billion (Allied Market Research)

- The workwear industry in the UK has an estimated market share of £284 million (IBISWorld)

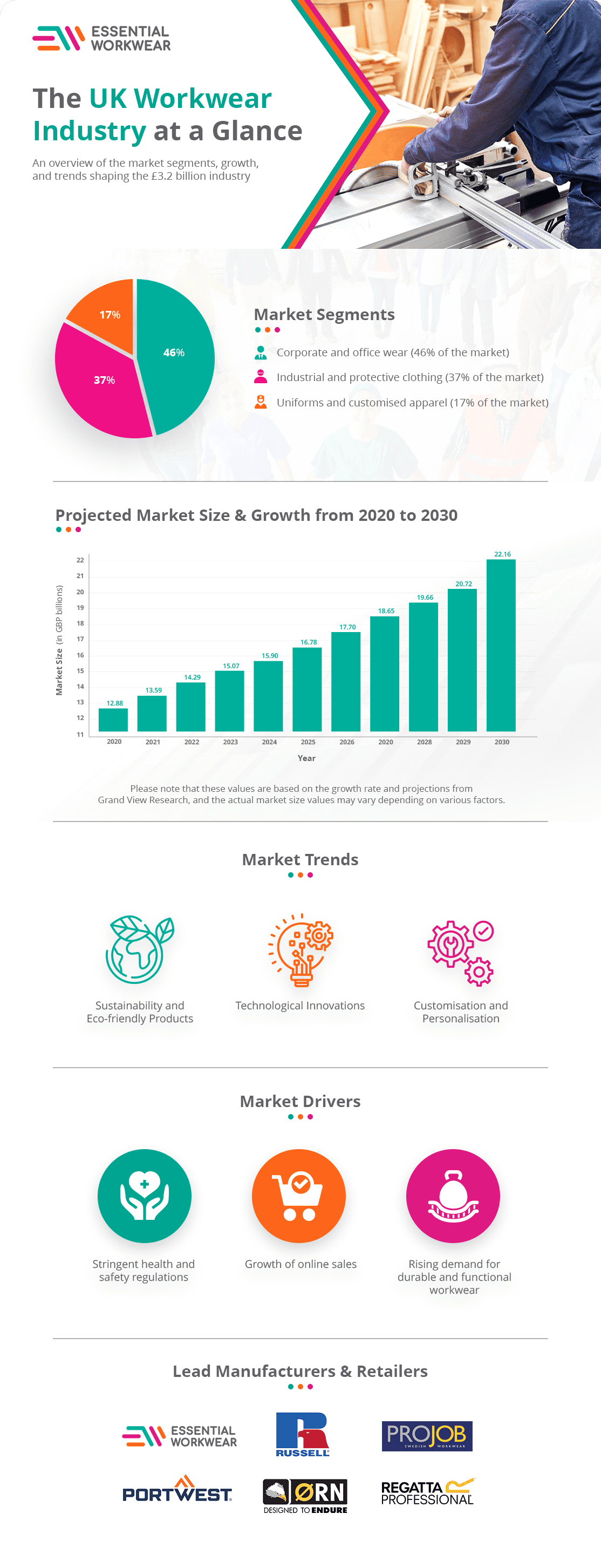

- Corporate wear accounts for 46% of the market. (Printwear and Promotion)

- The UK workwear industry is projected to grow by 2.2% in 2023. (Technavio)

- In 2019, the UK imported £135 million worth of workwear products from the EU. (Businesscoot)

- Work shirts alone account for an estimated 54% of industry revenue. (IBIS)

The UK workwear industry is a highly diverse sector that encompasses a wide range of products, including corporate wear, industrial and protective clothing, and uniforms. The initiative serves various sectors, including healthcare, hospitality, construction, manufacturing, and transportation.

The demand for workwear is driven by the need for safety, comfort, and professionalism in the workplace.

Share Statistics

Feel free to share our infographic with others – just be sure to link back to our original page at https://essentialworkwear.com/workwear-industry-statistics/. By sharing this infographic, you’re not only helping to educate others about the UK workwear market, but you’re also supporting a business that’s passionate about providing high-quality embroidered uniforms and logo-branded workwear for various industries. Let’s start a conversation and keep the workwear community informed and engaged.

Key Market Segments

The UK workwear industry is divided into various market segments that cater to the specific needs and requirements of employees across different industries. These market segments offer different types of workwear products that vary in design, function, and level of protection.

Corporate and Office Wear

Corporate and office wear is a key segment of the UK workwear industry, and it plays a significant role in creating a professional image for companies.

Corporate wear is the largest segment of the UK workwear industry, accounting for approximately 46% of the market. This segment caters to professionals who require professional-looking clothing that reflects their brand and corporate identity.

Corporate wear includes clothing such as suits, jackets, trousers, and skirts, which are tailored to meet the needs of different professions. The demand for corporate wear is driven by the need to create professional branding that reflects a company’s values and mission.

Industrial and Protective Clothing

Industrial and protective clothing is the second-largest segment of the UK workwear industry, accounting for almost 37% of the market. This segment caters to employees who work in hazardous environments and require protective clothing to ensure their safety.

The demand for industrial and protective clothing is driven by stringent health and safety regulations that require employers to provide their employees with appropriate protective clothing to perform their duties safely.

Industrial and protective clothing includes products such as high-visibility clothing, safety boots, gloves, and helmets, among others.

In the industrial and protective clothing sector, which accounts for a significant portion of the UK workwear market, safety extends beyond personal gear. For workers in hazardous environments, the quality of outdoor surfaces is crucial. An example could be Paving Shopper, specialising in high-grade paving materials, plays a vital role in this aspect. Their products ensure safe, durable surfaces for industrial settings, complementing the safety gear like high-visibility clothing, boots, and helmets essential for these demanding workplaces.

Uniforms and Customised Apparel

Uniforms and customised apparel are also significant segments of the UK workwear industry, with work shirts alone accounting for an estimated 54% of industry revenue. This segment caters to employees who require a uniform to perform their duties.

Uniforms and customised apparel help to create a sense of unity and identity among employees while also promoting the company’s brand. This segment includes products such as polo shirts, t-shirts, trousers, and jackets, among others.

Customisation and personalisation are also significant trends in this segment, with companies offering customised and personalised workwear to cater to individual needs and preferences.

Market Size and Growth

Current Market Value

The market has experienced steady growth in recent years due to increased demand for protective clothing and corporate wear.

The Covid-19 pandemic has also impacted the market, with increased demand for personal protective equipment (PPE) such as masks, gloves, and gowns, as well as workwear for healthcare professionals.

The pandemic has created new challenges and opportunities for the UK workwear industry, with companies adapting to the changing needs of consumers and the market.

Projected Growth

The UK workwear industry is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.2% in 2023. The growth is driven by the increasing demand for sustainable and eco-friendly products, technological innovations, and rising online sales.

Market Trends

Sustainability and Eco-Friendly Products

Sustainability and eco-friendliness are critical considerations for consumers in the UK workwear industry. The growing concern for the environment has led to an increased demand for sustainable and eco-friendly products, including workwear.

Companies are responding to this trend by developing and offering products made from environmentally friendly materials such as recycled fabrics, organic cotton, and biodegradable materials.

By using eco-friendly materials, companies can reduce their carbon footprint and meet the demands of environmentally conscious consumers.

Technological Innovations

The UK workwear industry is also being driven by technological innovations, which are rapidly transforming the industry.

Companies are integrating technology into their products to improve comfort, functionality, and safety. For example, smart fabrics are being developed that can regulate body temperature and prevent odour.

Wearable technology, such as smartwatches and fitness trackers, is also being incorporated into workwear to monitor employee health and safety.

Biometric sensors are another technological innovation being introduced in the industry to measure stress levels, heart rate, and other biometric data. These additions are expected to become even more prevalent in the future.

Customisation and Personalisation

Customisation and personalisation are also significant trends in the UK workwear industry. Companies are offering customised and personalised workwear to cater to individual needs and preferences.

Customisation allows employees to have their workwear tailored to fit their body type and comfort level, while personalisation allows them to add their name, job title, or company logo to their workwear.

This trend has become increasingly popular in the industry as it allows companies to create a unique brand identity while providing employees with comfortable and functional workwear that meets their individual needs.

Market Drivers

Stringent Health and Safety Regulations

Stringent health and safety regulations are a significant driver of the UK workwear industry. Employers are required by law to provide their employees with appropriate protective clothing to ensure their safety and well-being while performing their duties. These regulations cover various industries such as construction, healthcare, and manufacturing, among others.

The Health and Safety at Work etc. Act 1974 and Personal Protective Equipment at Work Regulations 1992 specify the requirements for protective clothing in different work settings. Failure to comply with these regulations can result in legal action against the employer, including fines and imprisonment.

This has driven the demand for workwear products that meet the required safety standards.

Growth of Online Sales

The growth of online sales is another significant driver of the UK workwear industry. Consumers are increasingly shopping online due to its convenience and accessibility, and companies are responding by offering their products through online channels.

The growth of eCommerce has also created new opportunities for small and medium-sized enterprises to reach a wider audience and expand their market share.

Many companies have developed eCommerce platforms to enable consumers to purchase their workwear products online, offering a wide range of products and customisation options to meet their needs.

Rising Demand for Durable and Functional Workwear

The rising demand for durable and functional workwear is driving the UK workwear industry. Consumers are looking for workwear that is comfortable, functional, and durable, and companies are responding by offering products that meet these requirements.

The healthcare sector is one of the fastest-growing markets for workwear in the UK, with healthcare professionals requiring workwear that is comfortable, functional, and durable to perform their duties effectively.

Similarly, the construction industry is a large consumer of workwear products, accounting for 20% of the market. Workers in this industry require workwear that is durable and functional to protect them from hazards such as sharp objects and debris.

Companies are developing products that meet these requirements, such as work boots with steel toe caps, high-visibility jackets, and flame-resistant clothing, to cater to the rising demand for durable and functional workwear.

Challenges Faced by the Industry

Fluctuating Raw Material Prices

Fluctuating raw material prices is a significant challenge faced by the UK workwear industry. The prices of raw materials such as cotton, polyester, and nylon are subject to market fluctuations, which can affect the cost of production and pricing strategies of manufacturers.

Competition from Low-Cost Imports

The UK is one of the largest importers of workwear products in the European Union, importing £135 million worth of workwear products from the EU in 2019. But competition from low-cost imports is another contemporary challenge facing the UK workwear industry.

The industry faces stiff competition from imports from countries with lower labour costs, which can affect the competitiveness of UK manufacturers.

Leading Workwear Manufacturers and Retailers

The UK workwear industry boasts several leading manufacturers and retailers that have established a reputation for offering quality workwear products that meet the needs of consumers.

One of these leading suppliers is Essential Workwear, an online retailer that specialises in providing high-quality workwear products at competitive prices. Essential Workwear has become a trusted name in the industry, with a wide range of products that cater to different sectors such as healthcare, construction, and hospitality.

The company offers a diverse range of workwear products, including corporate wear, industrial and protective clothing, and uniforms, among others. The company’s commitment to providing customers with high-quality products has helped it to establish a loyal customer base, with many customers returning to purchase their workwear products from the company time and time again.

In addition to Essential Workwear, other leading workwear manufacturers and retailers in the UK include Arco, Alexandra, Dickies, and JCB. These companies have contributed significantly to the growth of the UK workwear industry by offering quality products that meet the demands of consumers.

Future Outlook and Opportunities

The future of the UK workwear industry looks bright, with several opportunities for growth and expansion. The increasing demand for sustainable and eco-friendly products, technological innovations, and rising online sales are expected to drive the industry’s growth.

Retailers can also explore new markets, such as healthcare, hospitality, and service industries, to expand their customer base and drive further innovation within the industry.

Conclusion

In conclusion, the UK workwear industry is a significant contributor to the country’s economy, serving various sectors that require specialised clothing to perform their duties. The industry faces several challenges, including fluctuating raw material prices and competition from low-cost imports.

However, the industry’s future looks bright, with several opportunities for growth and expansion led by new market trends and drivers. The industry can take advantage of these opportunities to continue driving the country’s economic growth and retailers can harness these significant opportunities to innovate and expand their reach.